This is the Most Misunderstood Concept in All of Finance

Why understanding convexity can save you money in the long run.

What are some of the most misunderstood concepts when it comes to money? Compounding and the idea of the time value of money is something I often see people struggle with. Compounding is the idea that money grows much faster at later stages as there is interest on top of interest, and the time value of money is that money today is more valuable than money a year from now because of opportunity cost and inflation.

But the topic of today’s article is far more advanced than this. This is an idea often finance professionals get wrong and don’t understand. Many portfolio managers lose their jobs for not understanding this. In this article, I want to discuss the importance of understanding convexity for active option traders and portfolio managers.

What is Convexity?

Convexity refers to the curvature or the non-linear relationship between the price of a financial instrument and its yield or interest rate. We humans have trouble imagining non-linear relationships. Most things we experience are linear, while most natural relationships are convex.

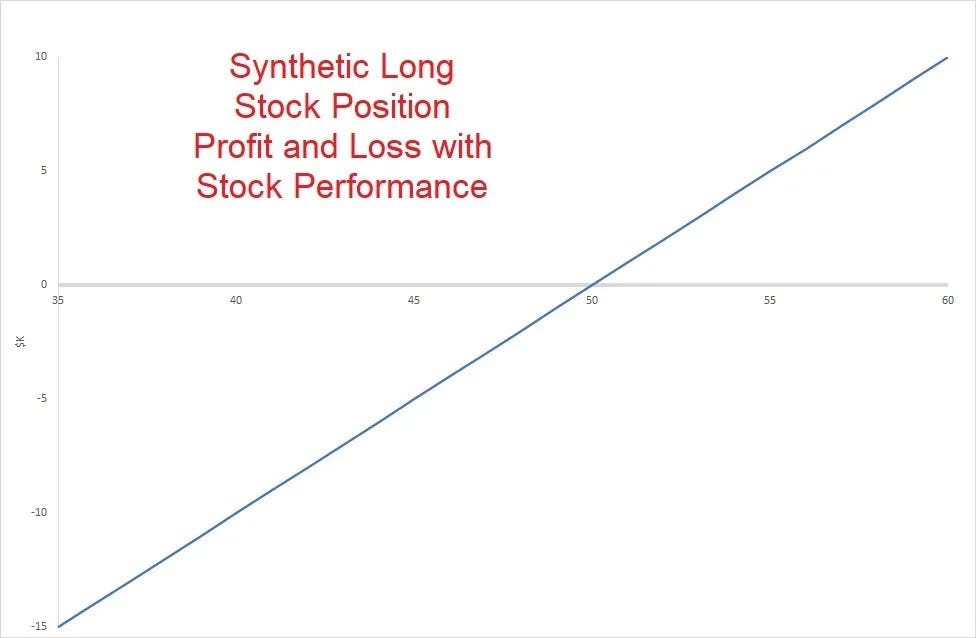

Investing, in most cases, is linear. For every dollar a company’s stock goes up, your profit and loss go up by a dollar.

The chart below shows this relationship very well.

However, the relationship is no longer linear when investing in other instruments, such as options or bonds. This means that, at some point, profit and loss become exponential. Now, if you have positive convexity, the benefits come your way. If you have negative convexity, the trade goes against you.

Think of convexity as a bodyguard. A very buff and ripped individual is standing next to you. You want him to protect you (positive convexity.) You do not want him to hit you or be out there to beat you up (negative convexity.)

Trading is similar. You want this buff man to be on your side, i.e., have positive convexity in most of your trades and manage this phenomenal effectively. Setups with negative convexity are often higher probability setups, but the person owning these instruments must know how these work.

How to Manage Convexity

Now that we have defined what convexity is, let’s explore how to manage this and ensure you are on the right side of the trade. Convexity is shown very simply in options. Let’s explore that with an example. Imagine you buy a call option on Apple stock. Do you see the curvature in the payoff? That is convexity. This is when you make the big bucks. When the move is faster than expected and $ rack up much faster.

Notice how most trades with positive convexity have a lower probability.

Now let’s examine negative convexity. This is when you are long a long-duration bond, and the rates rise. Or when you are short an option and the stock moves against you. Look at that curvature now against you, this is like that buff guy in the top picture is after to hit you! This is when losses rack up and you lose your job as a portfolio manager.

Notice how this is a higher probability trade, but you will lose much more if it is against you.

Think of the probability of making money and convexity as a sea saw and trade-off. One goes up, the other goes down.

Conclusion

I wrote this article and am offering it for free so more people can see it because I see and hear many people often say that the path to financial freedom is selling options. Well, that is not entirely true. The selling option might have a higher probability but has negative convexity.

The path to financial freedom is learning the fundamentals of money, finance, and trade, knowing these things, and managing your portfolio accordingly. I use Interactive Brokers for all of my trading. They have some of the best analytics and trading software for active traders. Check them out here:

Disclaimer

The opinions provided in this newsletter are mine and mine only and do not represent any firm or other affiliation.

You understand that NO content published and discussed during this newsletter constitutes a recommendation that any particular investment, security, portfolio of securities, transaction or investment strategy is suitable for any specific person.

You further understand that I will NOT advise you personally concerning the nature, potential, value or suitability of any particular investment, security, portfolio of securities, transaction, investment strategy or other matter.

This presentation and the content provided are for educational purposes only.